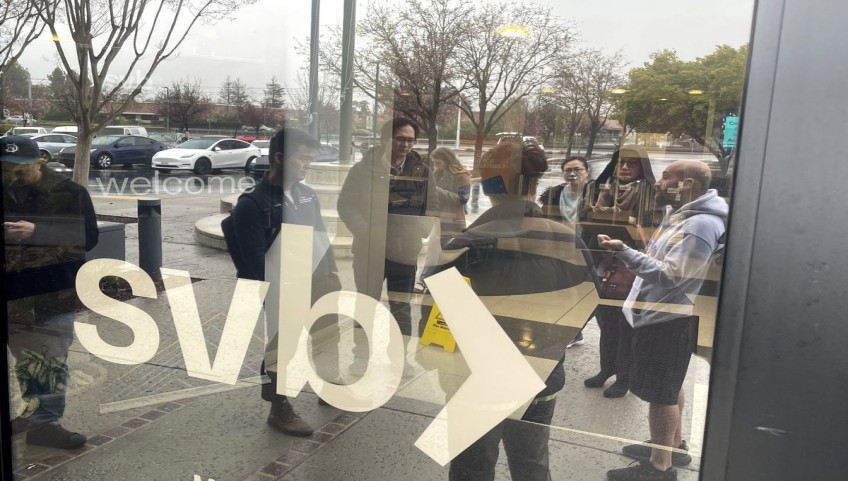

Silicon Valley Bank, one of the most prominent banks in the technology and startup industry, has experienced a significant failure in recent years. Despite its reputation for providing financial services to innovative startups, the bank's strategies and decisions have led to a series of losses, resulting in decreased profits and damaged trust among its clients.

One of the primary reasons for Silicon Valley Bank's failure was its overreliance on lending to the technology industry. The bank's focus on startups and early-stage companies made it particularly vulnerable to market fluctuations and downturns. As a result, when the tech bubble burst in the early 2000s, Silicon Valley Bank was heavily impacted, with a significant number of its clients unable to repay their loans.

Furthermore, Silicon Valley Bank also failed to adapt to changes in the industry. As new fintech companies emerged and disrupted the traditional banking industry, Silicon Valley Bank remained stuck in its old ways, failing to innovate and update its strategies. The bank's outdated approach to banking made it difficult for it to compete with newer, more agile players in the industry.

Another factor contributing to Silicon Valley Bank's failure was its lack of risk management. The bank made risky investments, which proved to be costly, particularly during the 2008 financial crisis. The bank also had a large exposure to the real estate market, which led to significant losses when the market crashed.

Moreover, the bank's internal culture was also problematic. There have been reports of a toxic work environment, with claims of discrimination and harassment, which resulted in several lawsuits filed against the bank. This not only tarnished the bank's reputation but also resulted in significant financial losses due to legal expenses and settlements.